Recurring billing is essential for SaaS businesses to ensure predictable revenue, improve customer retention, and automate payment processes. Here's a quick breakdown of what you need to know:

- Recurring Billing Models: Fixed, variable, and tiered billing options cater to different customer needs.

- Key Benefits: Predictable income, stronger customer loyalty, and reduced administrative tasks.

- Challenges: Failed payments (53% due to insufficient funds), compliance requirements, and scaling billing systems.

- Solutions: Use dunning management, implement retry cycles, and choose a payment provider that supports your pricing strategy and compliance needs.

- Integration Steps: Configure APIs, set up webhooks, and secure payment systems with PCI DSS standards.

- U.S. Market Considerations: Support USD, handle tax compliance, and manage chargebacks effectively.

To succeed, automate billing, improve failed payment recovery, and track metrics like revenue leakage and invoice accuracy. A well-optimized billing system not only simplifies operations but also supports business growth over time.

Recurring Billing Basics

What is Recurring Billing?

Recurring billing is a payment setup where customers are automatically charged at regular intervals for continued access to a SaaS product or service. Think of it as setting up autopay - once the customer authorizes the payment, the system handles the rest, deducting the agreed fee at each billing cycle.

This process remains in place until the customer decides to cancel, upgrade, or downgrade their subscription. Often referred to as subscription billing, this approach is the backbone of revenue generation for many successful SaaS companies in the U.S.

SaaS businesses typically offer different recurring billing models to cater to various customer needs:

- Fixed recurring billing charges a consistent fee, regardless of usage - much like Netflix’s flat monthly rate.

- Variable recurring billing adjusts fees based on usage or the number of users, making it suitable for services with fluctuating demand.

- Tiered recurring billing offers multiple packages with varying features and prices, giving customers flexibility to choose what fits their needs and budget.

The automation behind this system is its key strength. Customers provide their payment details once, and the system takes care of subsequent charges until the subscription is canceled. This automated setup is a stepping stone to understanding the broader strategic advantages it offers SaaS companies.

Benefits for SaaS Companies

Recurring billing offers SaaS businesses a reliable revenue stream, making it easier to predict income on a monthly or annual basis. This predictability enables more informed and strategic decision-making.

It also strengthens customer relationships. Studies show that 64% of consumers feel more loyal to brands with subscription models. This loyalty often leads to better retention rates and higher customer lifetime value.

On an operational level, recurring billing reduces administrative burdens by automating tasks like invoice creation, payment processing, and account management. This efficiency allows teams to focus on areas like product innovation and customer support.

The model also opens doors for revenue growth through cross-selling and upselling opportunities. Plus, it simplifies revenue tracking and reporting, ensuring a smoother process for managing income over time. Interestingly, annual subscriptions tend to have a churn rate that’s 9.5% lower than monthly plans, although monthly plans achieve a 13.9% higher acquisition rate.

Common Problems and Solutions

While recurring billing is efficient, it’s not without challenges. Failed payments are a major issue - research from Forrester shows that insufficient funds account for 53% of recurring payment failures, which in turn can cause up to 48% of total churn.

To address this, effective dunning management is essential. This includes strategies like sending pre-dunning emails, offering backup payment options, and implementing customized retry cycles. For example, in 2021, Chargebee helped businesses recover over $75 million through smart dunning practices.

Technical issues can also lead to involuntary churn, which accounts for 20–40% of churn in many SaaS companies. Whiteboard, for instance, managed to reduce involuntary churn and boost their monthly recurring revenue by 35% through improved dunning management.

As businesses grow, scaling the billing infrastructure becomes another challenge. Many SaaS companies find that in-house billing systems struggle to handle multiple pricing tiers, international payments, and compliance requirements. Established recurring billing platforms can help overcome these hurdles.

Compliance is another critical factor, particularly in the U.S. Billing systems must adhere to PCI DSS standards to protect sensitive payment data. Techniques like tokenization, which replaces sensitive data with non-sensitive substitutes, and account updater services, which refresh expired or updated card details automatically, are vital for maintaining security.

"Your mantra for collections should be that every customer is unique and requires personalized communication. Like any good marketing strategy, take time to fully understand your target audience and their behavior for an effective engagement." - Aditya Tulsian, Director, Chargebee Receivables

Finally, as billing processes grow more complex, revenue recognition becomes trickier. Automating reconciliation and using built-in reporting tools can streamline the tracking of income across different subscription models and billing cycles. This is particularly useful when managing upgrades, downgrades, prorated charges, and refunds.

Building a COMPLETE SaaS Billing System w/ Rails and Stripe

Selecting and Setting Up Your Payment Solution

Once you’ve got a handle on the basics of recurring billing, the next step is picking and implementing a payment solution that fits your subscription model.

How to Pick a Payment Provider

The right payment provider should align with both your current needs and where you see your SaaS business heading in the future.

Start by outlining your business requirements. Are you sticking with a straightforward recurring billing setup, or do you need something more advanced, like usage-based pricing? It’s worth noting that nearly 40% of consumers cancel subscriptions, so having features like dunning management and smart retries can help reduce churn.

Here are some key features to look for:

- Flexible billing options that match your pricing strategy

- Seamless integrations with your CRM and accounting tools

- Top-notch security, including PCI compliance and tokenization

If you’re eyeing international growth, make sure the provider supports multi-currency transactions and can handle tax compliance across regions.

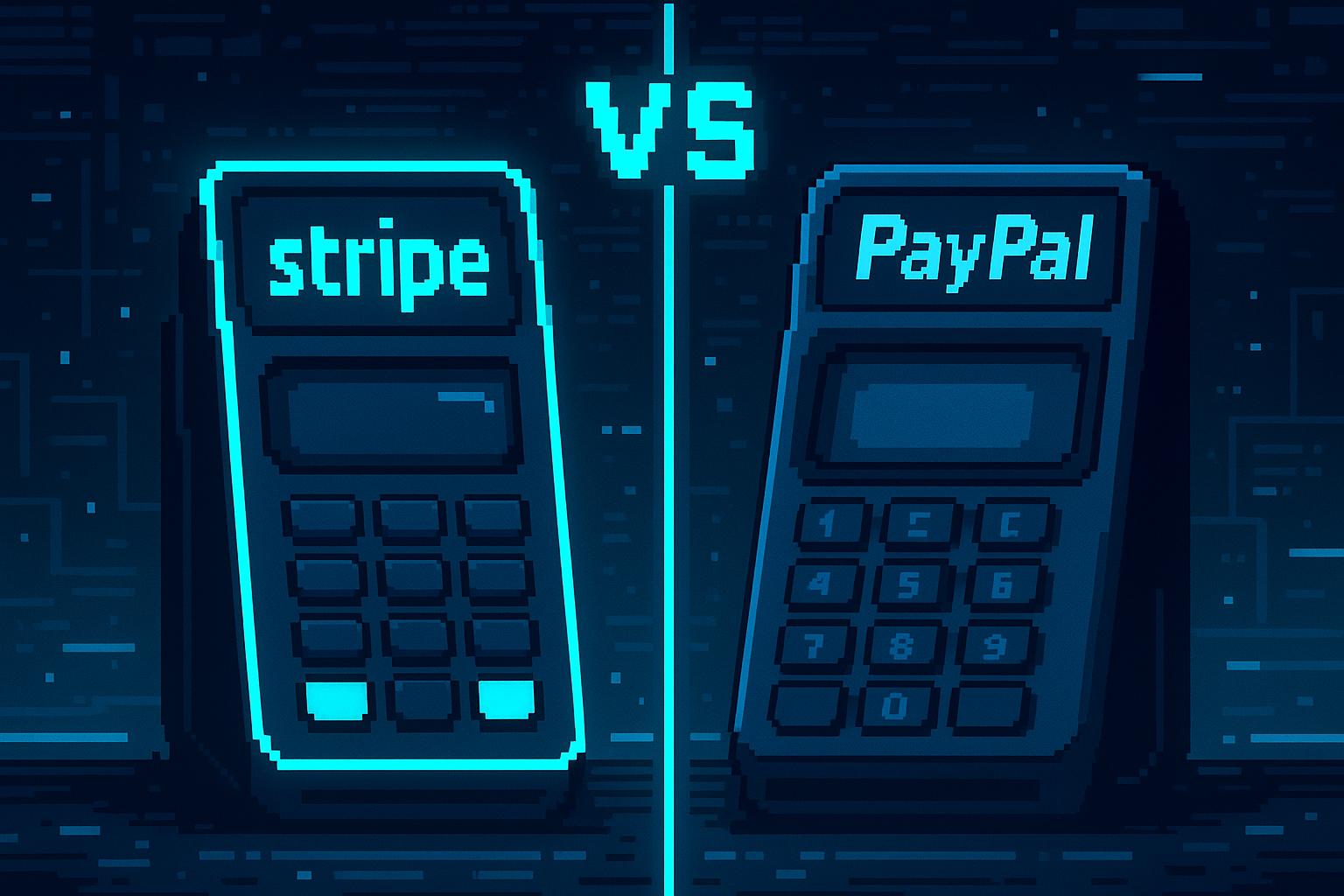

When comparing providers, don’t just focus on transaction fees. Look at the overall cost, including subscription fees and any extra charges. For instance, Stripe Billing has tiered pricing starting at $620 per month for up to $100,000 in monthly billing, while Chargebee offers free service for the first $250,000 in cumulative billing, then charges 0.75% on billing, with paid plans starting at $599 per month.

For a deeper dive into specific providers, check out resources like Choose a Payment Provider for Your SaaS, which compares options like Stripe (2.9% + $0.30 per transaction) and Paddle (5% + $0.50 per transaction), the latter also acting as a merchant of record. Testing platforms through free trials or demos is a smart move, especially to confirm compatibility with your existing systems.

Once you’ve chosen a provider, focus on integrating it smoothly into your billing system through API connections.

Integration Steps

Integrating your payment solution requires careful planning to ensure everything runs smoothly.

Start with API configuration. Use RESTful APIs to connect the payment system to your SaaS platform. Obtain your API keys and set up webhooks to manage real-time notifications for events like successful payments, failed charges, and subscription updates.

Security is critical. Even if your provider handles some compliance aspects, make sure your integration uses strong encryption, tokenization, and adheres to PCI DSS standards. HTTPS encryption for all data transmissions is non-negotiable.

Next, configure your billing logic to handle a variety of subscription scenarios. This might include:

- Calculating proration for mid-cycle plan changes

- Managing free trials effectively

- Setting up grace periods for failed payments

Your system should also support popular U.S. payment methods, including major credit cards and ACH transfers.

Webhooks play a vital role in keeping everything synchronized. Set up endpoints to receive notifications for payment successes, failures, and subscription cancellations. Adding retry logic can help address temporary network issues.

Before going live, test your system thoroughly. Simulate different scenarios, such as successful transactions, failed payments, subscription changes, and edge cases like expired cards or insufficient funds. Many providers offer sandbox environments for testing without using real money.

U.S. Market Requirements

If you’re operating in the U.S., there are specific considerations for currency, compliance, and customer preferences.

Configure your system to use USD ($1,234.56) and the MM/DD/YYYY date format. In the U.S., credit and debit cards dominate, with Visa and Mastercard being must-haves. ACH transfers are also gaining traction, especially in B2B SaaS, as they often come with lower transaction fees and can help reduce churn. Providers like GoCardless specialize in direct debit payments, charging 1% + $0.25 per transaction (capped at $2.50).

Compliance goes beyond PCI DSS standards. Visa and Mastercard have specific rules for subscription-based businesses, particularly when it comes to free trials and negative option billing. You’ll need to secure clear customer consent, provide an easy cancellation process, and send detailed transaction receipts that include payment and cancellation information.

Sales tax compliance can be tricky, especially when dealing with multiple states. Look for billing systems that integrate with tax calculation tools to automatically apply the correct tax rates based on customer locations.

Finally, managing chargebacks is crucial. Use clear billing descriptions for recurring charges - especially after free trials - and keep a close eye on chargeback rates. Proactively communicating with customers and making cancellation options easy to find can help minimize disputes. With the subscription economy projected to hit $1.5 trillion by 2025, setting up a payment system that meets U.S. regulations is key to scaling your business and tapping into growth opportunities.

Building Subscription Management and Customer Experience

Once your payment infrastructure is in place, the next step is creating a seamless experience for customers to manage their subscriptions while ensuring efficient back-end billing operations. A secure and automated billing system lays the foundation, but a polished customer experience is what keeps your business growing.

Customer Self-Service Portals

A well-designed self-service portal is a game-changer. It reduces support requests and gives customers full control over their subscriptions. The portal should allow users to view their plans, download invoices, update payment methods, and make plan changes. A clean, intuitive interface with clear navigation and labeled buttons ensures customers can complete tasks without frustration.

At the heart of any self-service portal is its payment and billing functionality. Customers should be able to review billing history, process payments, set up automatic billing, and even cancel subscriptions if necessary.

Several platforms offer self-service tools to streamline this process. For instance:

- HubSpot Service Hub: Includes a knowledge base, help desks, and live chat integrated with its CRM.

- Salesforce Service Cloud: Provides a robust knowledge base, contract management, entitlements, and community forums.

- Clinked: Offers a white-label client portal for personalized experiences and secure file sharing.

"Self-service portal lets customers conveniently and efficiently access the information they need to resolve issues on their own. Your customers are happy as they feel in control and satisfied. Meanwhile, your support team avoids attending to certain requests and focuses on other important business activities." – Clinked Team

Integration is critical. Your portal should connect seamlessly with your billing platform, CRM, and support tools to ensure customers receive consistent information across all channels.

Automated Billing Communications

Keeping customers informed about their billing status builds trust and reduces confusion. Automated notifications for key billing events - such as successful payments, upcoming renewals, failed transactions, and plan changes - are essential. Payment confirmations should include clear transaction details, while renewal reminders help customers prepare for future charges.

Using a standardized messaging system allows you to tailor communications for different customer segments and optimize them for various devices. Monitoring delivery and open rates can help fine-tune your approach over time.

Special attention should be given to credit card expiration reminders. Sending friendly notifications 30 and 15 days before a card expires encourages customers to update their payment details. Providing transparent breakdowns of charges and usage details also helps build trust and reduces disputes. These steps lay the groundwork for effective failed payment recovery strategies, which we’ll explore next.

Handling Failed Payments

Failed payments are an unavoidable part of subscription businesses, but how you handle them can determine whether customers stay or leave. With 7–10% of payments failing and involuntary churn accounting for 20–40% of overall churn, having a solid recovery strategy is essential.

Understanding why payments fail is the first step. Common reasons include:

- Low account balances (26%)

- Invalid payment information (30%)

- Expired credit cards (24%)

Each failure type requires a tailored approach. Implementing dynamic retry logic is key. This involves adjusting retries based on failure codes, payment history, and method-specific constraints. Effective retry strategies can recover 45–70% of failed payments, with top-performing SaaS businesses reaching recovery rates of 70–85%.

Pair these retries with personalized communication as part of your dunning management process. Customize messages based on the failure reason and customer segment, and offer resolution options like updating card details or using alternative payment methods. For loyal customers with a good payment history, offering a grace period can help resolve issues without disrupting service.

Using real-time validation tools, such as Account Updater services, can also prevent failures by automatically refreshing card details. For example, Recover Payments helped Awesome Motive recover over $17,000 in revenue within five months.

"A 5% improvement in payment recovery often exceeds the revenue impact of a full percentage point of growth in new customer acquisition." – Executive, Chargebee

Treat each customer individually. Segment your audience by payment failure reasons, payment history, invoice value, and payment patterns to design targeted and effective recovery campaigns.

sbb-itb-a989baf

Testing and Improving Your Billing System

Once you've set up your customer experience and payment recovery systems, the next step is making sure your billing system runs smoothly. A glitchy billing process can hurt customer relationships and lead to revenue losses, so thorough testing and regular improvements are essential.

Complete System Testing

It's critical to test every billing scenario from start to finish. This includes running successful transactions across different subscription plans, billing cycles, and payment methods to confirm that charges, invoices, and confirmations work as they should.

You should also simulate failed transactions - like payments declined due to insufficient funds, expired cards, or incorrect details. This helps ensure that your retry processes and notifications are functioning properly. Refunds and proration calculations need to be tested across all subscription types, and chargeback scenarios should be reviewed to confirm your system handles disputes accurately and keeps records up to date.

Regular testing becomes even more important when you update or modify your system. One expert emphasizes the importance of frequent testing, especially after updates, to maintain accuracy and reliability. Scheduling periodic audits of your billing processes can help catch and fix issues before they affect your customers.

Once your testing is complete, use performance metrics to identify areas for improvement.

Key Performance Metrics

Tracking key metrics is essential to evaluate the reliability of your billing operations. Here are a few critical ones to monitor:

- Days Sales Outstanding (DSO): This measures how quickly you collect payments. Industry averages range from 45-55 days, but top performers keep this lower, maintaining 30% more cash reserves.

- Revenue Leakage: This represents revenue lost due to billing errors. Leading SaaS companies keep this below 1-2% of total revenue.

- Invoice Accuracy Rate: Best-in-class companies achieve over 98% accuracy, while the average failed payment rate across industries is 5-9%, with top performers keeping it under 4%.

- Billing Cycle Time: Efficient companies complete billing cycles in under three business days, compared to a week or more for less efficient competitors.

Monitoring these metrics doesn't just improve operations - it can also impact your company's valuation. SaaS companies with structured billing metric tracking often see valuations 1.8x higher, while poor billing experiences can influence renewal decisions for 77% of B2B customers. Patrick Campbell, founder of ProfitWell, highlights the importance of clean billing operations:

"VCs and acquirers increasingly examine the billing infrastructure as a risk factor. Companies that can't demonstrate clean billing operations often face valuation discounts of 10-15%."

Atlassian offers a great example of how focusing on these metrics can lead to significant improvements. By implementing a robust billing metrics program, they reduced DSO from 52 days to 37 days, cut revenue leakage from 4.2% to 0.8%, improved invoice accuracy from 92% to 99.3%, and saw a 62% drop in billing-related support tickets. Cameron Deatsch, Atlassian's Chief Revenue Officer, shared:

"Optimizing our billing operations wasn't just about financial efficiency - it fundamentally transformed our customer experience and freed up capital for strategic investments."

Ongoing System Updates

Your test results and performance metrics should guide continuous improvements to your billing system. As your business grows and the market evolves, your billing system needs to scale to meet new demands. With the SaaS market projected to grow at 7.33% annually through 2028, reaching $374.50 billion, staying ahead is crucial.

Regular updates help keep your billing system efficient and secure. Pay attention to customer feedback - survey users about their billing experience, payment preferences, and any issues they encounter. Use this input to refine your self-service options and improve communication templates.

Staying compliant with regulations is another ongoing task. Keep up with changes in tax laws, data protection rules, and industry standards. Make sure your billing platform adheres to guidelines like ASC 606 and IFRS 15, especially as you expand into new markets.

Plan technology updates carefully. Implement a disaster recovery plan to minimize risks like data loss or downtime during system upgrades. Regular performance audits can help identify inefficiencies and improve productivity.

Finally, consider how payment trends are evolving. By 2023, over 61% of SaaS companies had adopted usage-based pricing models, up from 34% in 2020. Your billing system should be flexible enough to support new pricing structures and payment methods as customer preferences shift.

Investing in a dedicated billing platform can deliver an average ROI of 172% over three years, making regular system improvements a smart move. Conducting audits and refining your processes ensures your billing system continues to support your business growth effectively.

Conclusion: Creating a Growth-Ready Billing System

Recurring billing for your SaaS business isn’t just about collecting payments - it’s about laying down a foundation that can scale as your company grows. The trick is to anticipate complexity early on, rather than scrambling to patch things together when customer demands evolve.

Start with the essentials: flexible pricing plans, secure payment processing, PCI-compliant checkouts, trial options, and automated invoicing. But as Matthew Busel from MakeSpace points out:

"When you build anything as complex as billing, it is inherent that you won't be able to build all of the complex requirements your team desires. You will know this in-house system will break and have issues unless you've dedicated a lot of time and resources to it."

Taking a strategic approach from the outset allows you to embrace automation and global readiness. Cloud-based systems, for example, are better equipped to handle growing user demand compared to on-premise solutions. Plus, they free up your engineering team to focus on your core product. Nathan Field from Drawboard highlights this perfectly:

"The big thing for a billing platform is not just about building, but also maintaining. If our cloud engineers will be building, maintaining, and expanding what our billing architecture looks like internally, then they're not focused on scaling our core value prop."

Automation is the backbone of scaling. Tasks like billing, invoicing, revenue recognition, and payment recovery should operate seamlessly without manual effort. Features such as smart retry systems, automated payment updates, and dunning management reduce involuntary churn and keep revenue steady. What works for a small customer base won’t cut it when you’re managing thousands of accounts.

As automation frees up resources, prepare to go global. Supporting multiple currencies and payment methods from the beginning simplifies international expansion. Retrofitting these capabilities later can be costly and time-consuming, so it’s smarter to plan ahead.

Additionally, keep thorough records of system configurations and feature integrations. This documentation is invaluable for scaling, troubleshooting, and onboarding new team members as your customer base grows.

Streamlined billing doesn’t just simplify operations - it directly impacts your cash flow. In 2023, 55% of all B2B invoiced sales in the U.S. were overdue. A well-designed billing system minimizes friction, ensuring payments are processed smoothly and on time.

Companies that prioritize robust billing systems are better positioned to capture growth and avoid operational setbacks. On the other hand, those that neglect this critical area often face valuation challenges and bottlenecks that stunt their potential.

Your billing system isn’t just a tool - it’s a growth engine. By integrating scalable features, automation, and global capabilities from the start, you’re setting your business up for success at every stage of its journey.

FAQs

What are the best ways to recover failed payments in a SaaS subscription model?

Recovering Failed Payments in SaaS

Recovering failed payments is essential for keeping your revenue stream consistent in a SaaS business. Here are some proven strategies to tackle this issue effectively:

- Automated payment retries: Set up retries spaced out over a few days or weeks. This helps address temporary issues like insufficient funds without overwhelming the customer.

- Personalized customer reminders: Send friendly, customized emails or notifications to alert users about the failed payment. Include clear instructions to update their payment details, making the process as simple as possible.

- Offer multiple payment methods: Flexibility is key. By accepting options like credit cards, PayPal, or ACH transfers, you lower the chances of permanent payment failures.

- Smart dunning workflows: Use automated tools to manage follow-ups and recover payments efficiently. These systems ensure your recovery process is smooth while keeping the customer experience intact.

Using these strategies together can boost your recovery rates, reduce churn, and help maintain strong customer relationships.

How can SaaS businesses comply with PCI DSS standards when setting up recurring billing?

To meet PCI DSS standards for recurring billing, SaaS businesses need to focus on secure payment methods and consistent compliance checks. The first step is to rely on a PCI-compliant payment gateway to securely manage sensitive customer information. Beyond that, ensure your systems are up to date with the latest PCI DSS requirements by implementing measures like strong access controls, encrypting payment data, and performing regular security audits.

Equally important is keeping detailed records of your compliance efforts. This includes documenting the scope of your security measures and validating compliance either annually or semi-annually, based on your transaction volume and business size. Taking these proactive measures not only protects customer data but also reinforces trust in your subscription services.

What should I look for in a payment provider to support my SaaS business's growth?

When choosing a payment provider for your SaaS business, prioritize scalability, security, and how easily it integrates with your platform. Make sure the provider supports multiple payment methods, including credit cards and digital wallets, while adhering to U.S. regulations like PCI DSS for secure transactions.

Take the time to review transaction fees, the availability of detailed reporting tools, and whether the provider can handle multiple currencies - especially if global expansion is part of your plans. Opting for a provider that fits your growth strategy can streamline subscription management and deliver a smooth, hassle-free experience for your customers.