Running a global SaaS business can be overwhelming with challenges like managing recurring payments, handling multi-currency transactions, ensuring tax compliance, and preventing fraud. A Merchant of Record (MoR) simplifies these complexities by taking responsibility for payment processing, tax collection, and compliance across different countries, allowing you to focus on growth.

Here are the top 5 Merchant of Record solutions tailored for SaaS businesses:

- Paddle: Designed specifically for SaaS businesses, it automates tax compliance, offers advanced subscription management, and provides global payment support.

- FastSpring: Focuses on international expansion with automated tax handling, flexible billing cycles, and a customer-friendly checkout experience.

- Cleeng: Specializes in subscription management with tools to reduce churn, support for 200+ payment methods, and global tax compliance.

- Dodo Payments: A practical choice for freelancers and small SaaS businesses, offering basic recurring billing, tax management, and multi-currency support.

- Verifone: A seasoned player with extensive global payment capabilities, enterprise-grade tools, and robust tax compliance systems.

Quick Comparison

| Provider | Payment Methods | Tax Compliance Coverage | Subscription Features | Best For |

|---|---|---|---|---|

| Paddle | Credit cards, wallets | Global VAT, GST, US sales tax | Advanced tools | SaaS startups |

| FastSpring | 20+ currencies, localized options | Global automation | Flexible billing | Mid-sized SaaS |

| Cleeng | 200+ methods, 135 currencies | 50+ jurisdictions | Churn prevention | Subscription-heavy SaaS |

| Dodo Payments | Major currencies, regional options | Select markets | Basic tools | Freelancers, micro-SaaS |

| Verifone | 100+ currencies, omnichannel tools | Comprehensive global | Enterprise-grade | Large, enterprise SaaS |

Each of these platforms offers unique strengths, from Paddle's SaaS-specific focus to Verifone's enterprise-level capabilities. When choosing, consider factors like your target markets, subscription needs, and integration requirements.

What is a merchant of record (MoR)?

Key Features to Consider in a Merchant of Record Solution

Choosing the right Merchant of Record (MoR) solution is a crucial step for any SaaS business aiming to streamline operations and expand globally. To make the best decision, you’ll need to evaluate several essential features that directly influence your business performance. Let’s dive into what to look for.

Global Payment Support is the backbone of any reliable MoR solution. Your provider should support a wide range of payment methods, including credit cards, digital wallets (like PayPal and Apple Pay), and region-specific options such as SEPA or Alipay. It’s also important that they process payments in multiple currencies with competitive exchange rates. This not only allows you to price your services in local currencies but also reduces friction during the checkout process.

Tax Compliance Automation is a must-have for navigating the complex world of international taxes. The ideal provider will handle VAT registration, calculation, and remittance across all your operating regions. They should also manage reverse charge mechanisms for B2B transactions and monitor tax thresholds. Additionally, the ability to generate invoices that comply with local regulations can save you the headache of dealing with tax laws in multiple jurisdictions.

Subscription Management Capabilities are vital for SaaS businesses with recurring revenue models. Look for support for features like plan upgrades or downgrades, proration, dunning processes, and automated payment retries. A strong system should also handle various billing cycles, whether monthly or annual, and offer flexibility for complex pricing models such as tiered or usage-based billing.

Fraud Prevention and Security are critical for protecting your business and customers. Advanced fraud detection tools, like machine learning algorithms, can help identify fraudulent activity while minimizing false positives. Ensure the provider is PCI DSS compliant and offers security measures like 3D Secure authentication, velocity checks, and geolocation verification to reduce chargebacks and financial risks.

Integration Flexibility ensures the MoR solution fits seamlessly into your existing tools and systems. Look for providers with robust APIs, real-time webhooks, and pre-built integrations with popular SaaS platforms. This flexibility allows you to maintain control over the customer experience while leveraging the backend support of the MoR.

Pricing Transparency and Structure can significantly affect your bottom line. Understand the provider’s fee structure, including transaction fees, monthly minimums, and any setup or premium fees. Some providers charge a flat percentage per transaction, while others use tiered pricing based on volume. Knowing these costs upfront helps you budget effectively and compare options.

Reporting and Analytics features give you valuable insights into payment trends and customer behavior. Ensure the provider offers detailed transaction reports, revenue analytics, chargeback tracking, tax summaries, and real-time dashboards to monitor key metrics.

Customer Support Quality is especially important when payment issues arise. Choose a provider with fast response times, knowledgeable support teams, and dedicated account managers if your business requires more personalized attention.

Lastly, make sure the solution can scale as your business grows. Whether you plan to expand to new markets, handle larger transaction volumes, or introduce features like marketplace functionality or partner revenue sharing, your MoR should be ready to support your future needs without requiring a major overhaul.

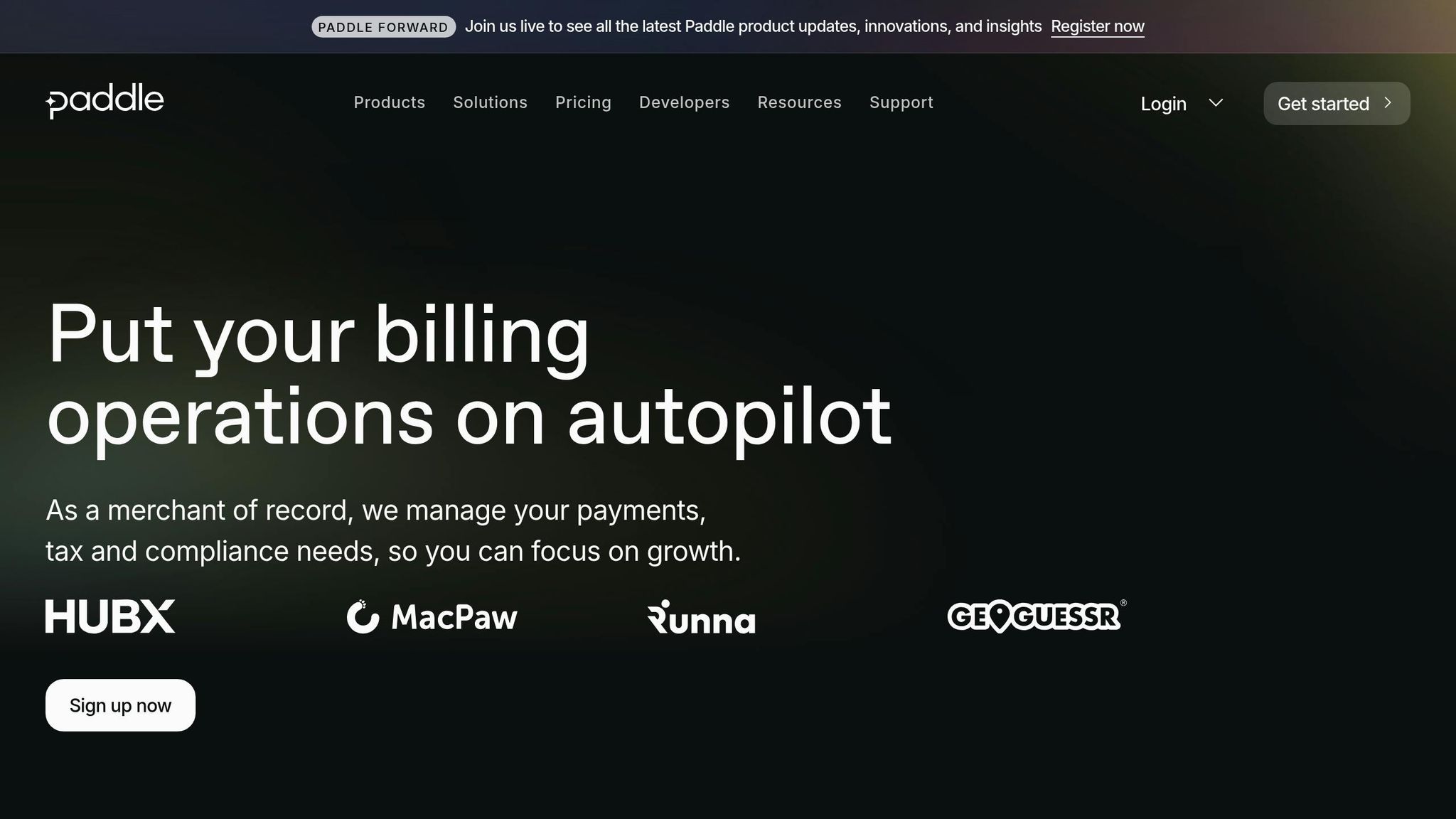

1. Paddle

Paddle is a specialized Merchant of Record (MoR) platform designed specifically for SaaS businesses. It takes the hassle out of payment processing and managing international tax compliance, allowing companies to concentrate on scaling their operations.

Automated Tax Calculation and Compliance

One standout feature of Paddle is its automation capabilities. The platform automatically calculates taxes based on customer location and transaction details, ensuring compliance with regulations in different markets. This hands-off approach simplifies a complex process, making it easier for businesses to operate globally.

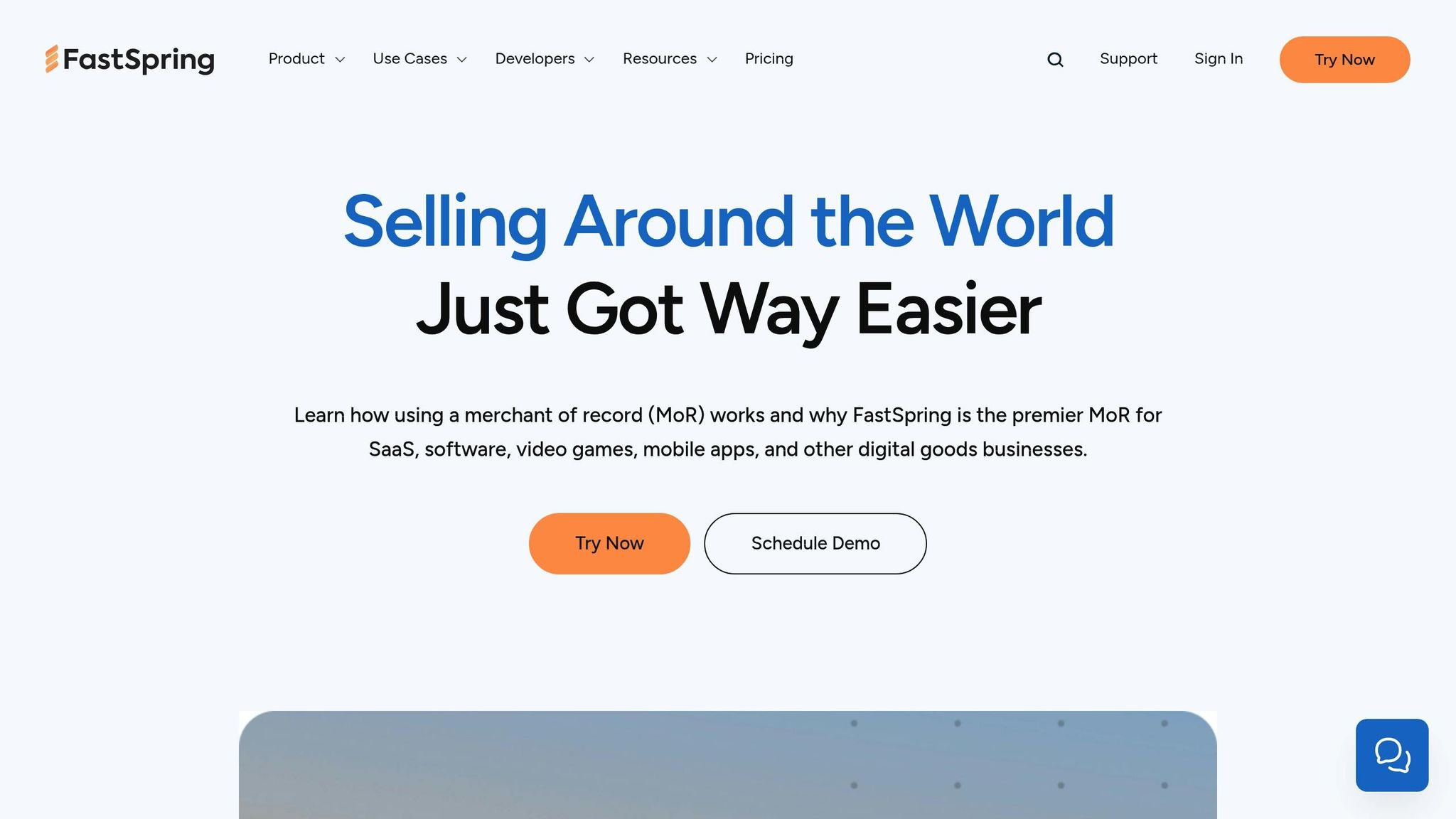

2. FastSpring

FastSpring addresses global challenges by blending compliance expertise with a focus on customer experience. It simplifies international expansion for SaaS businesses by managing the legal and financial complexities of global sales. This allows companies to prioritize product development and growth without getting bogged down by regulatory concerns.

Global Payment and Currency Support

FastSpring enables SaaS companies to accept payments from over 200 countries, supporting 20+ currencies like USD, EUR, and GBP. By offering localized payment options - including credit cards, PayPal, and regional alternatives - the platform helps improve conversion rates. Customers can pay in their preferred currency, creating a smoother purchasing experience. Additionally, FastSpring's localized checkout reduces cart abandonment and boosts revenue potential. These payment features integrate seamlessly with the platform's automated tax systems.

Automated Tax Calculation and Compliance

As the legal seller of record, FastSpring automatically calculates and remits sales taxes, VAT, and GST worldwide. This ensures compliance with local regulations across various jurisdictions, minimizing administrative work and legal risks for SaaS companies.

Subscription and Recurring Billing Management

FastSpring handles recurring billing, subscription updates, invoicing, payment retries, and dunning processes. These automated tools help prevent involuntary churn, ensuring a steady revenue stream for fast-growing SaaS businesses. The platform's billing features align with its integration tools to create a seamless experience.

Integration Flexibility and Developer Tools

FastSpring supports flexible integrations through APIs, webhooks, and pre-built connectors, allowing SaaS businesses to connect the platform with their existing tech stack. Its developer resources and detailed documentation make it easier to create custom workflows and address advanced use cases. This flexibility ensures businesses can maintain their existing customer experience while leveraging FastSpring's merchant of record services in the background.

FastSpring boasts an average rating of 4.5/5 from thousands of SaaS businesses, with users frequently praising its global reach, compliance automation, and responsive customer support. Its seamless integration process and reliable compliance tools make it a trusted partner for scaling SaaS companies.

3. Cleeng

Cleeng focuses on providing merchant of record services tailored for subscription-based SaaS businesses. It has built a strong reputation for managing the complexities of global subscriptions, offering reliable solutions for payment processing and compliance.

Global Payment and Currency Support

Cleeng operates in over 180 countries, supports 135+ currencies, integrates with 50+ payment gateways, and accepts more than 200 payment methods. This vast network enables SaaS companies to process payments ranging from traditional credit cards to region-specific options. By handling both major and minor currencies, the platform allows businesses to display prices in local currencies, making transactions more accessible for customers worldwide.

Automated Tax Calculation and Compliance

As a merchant of record, Cleeng takes care of tax calculation, collection, and remittance across 50+ jurisdictions, including the US, EU, and APAC regions. This means SaaS companies don’t have to set up local entities or navigate the complexities of regional tax systems on their own.

Cleeng assumes full legal responsibility for payment activities, ensuring compliance with VAT, GST, and sales tax regulations across markets. This automated system minimizes administrative tasks and reduces legal risks, freeing up businesses to focus on growth areas like product development and customer acquisition. Additionally, Cleeng’s compliance tools are designed to complement its subscription management features, creating a streamlined approach to recurring revenue.

Subscription and Recurring Billing Management

Cleeng’s SRM® suite integrates subscription management with billing automation, analytics, and churn prevention tools. This all-in-one setup helps SaaS companies maximize recurring revenue while maintaining steady subscriber bases.

The platform supports multiple subscription models and automated renewal processes. It also includes customer self-service portals, enabling users to manage their subscriptions, payments, and account details independently. This self-service functionality reduces the need for direct support, cutting costs while giving customers more control over their accounts.

Integration Flexibility and Developer Tools

Cleeng offers robust integration options through its APIs and SDKs, making it easy to connect with existing SaaS systems. By integrating with the broader SRM® suite, businesses can unify their payment, subscription, and compliance operations under one system.

The platform handles millions of transactions annually with a reported uptime of 99.99%, making it a dependable choice for high-volume environments like digital content delivery and SaaS. It also provides real-time analytics and reporting on metrics like revenue, churn, and customer engagement, empowering SaaS operators to make informed decisions based on data.

Cleeng boasts a 4.5/5 rating on major SaaS review platforms, with users highlighting its ease of integration, reliable tax compliance, and strong subscription management tools. Its pricing model is transaction-based, typically charging a percentage fee plus a fixed fee per transaction, with custom pricing available for high-volume clients.

sbb-itb-a989baf

4. Dodo Payments

Dodo Payments has carved a niche for itself as a go-to merchant of record (MoR) solution, particularly for SaaS businesses and freelancers. Its key strength lies in simplifying global payment processes while ensuring compliance with complex regulations. For companies seeking an all-in-one platform to manage payments and taxes seamlessly, Dodo Payments offers a practical solution.

Global Payment and Currency Support

One of the standout features of Dodo Payments is its ability to handle global payments in multiple currencies. Businesses can accept payments not only in U.S. dollars but also in other major currencies, along with regional payment methods. This flexibility makes transactions smoother for international customers, potentially increasing conversion rates by eliminating payment barriers.

Automated Tax Management and Compliance

Tax compliance can be a headache, especially for businesses operating across borders. Dodo Payments takes care of this by automatically calculating, collecting, and remitting sales taxes, VAT, and other applicable taxes. By managing these obligations on behalf of SaaS businesses, the platform helps companies navigate intricate tax regulations without diverting focus from their core operations.

Subscription and Recurring Billing Features

Managing subscriptions and recurring payments is another area where Dodo Payments excels. The platform handles everything from plan changes and renewals to resolving failed payments. These tools not only ensure uninterrupted billing but also help businesses reduce churn and maintain operational efficiency.

Developer-Friendly Integrations and Security

Dodo Payments supports seamless integration through its APIs and detailed documentation, making it easier for businesses to embed payment functionalities directly into their systems. The platform also provides onboarding support, responsive customer service, and robust technical resources to ensure smooth implementation and ongoing optimization. Furthermore, it prioritizes security by adhering to PCI DSS standards, protecting sensitive payment data during transactions. These features, combined with its global capabilities, make Dodo Payments a reliable choice.

5. Verifone

Verifone has built a strong reputation as a seasoned player in the merchant of record space, offering over 40 years of payment processing expertise to SaaS businesses across the globe. Operating in more than 165 countries, Verifone is a go-to choice for SaaS companies aiming to expand their reach internationally. Here’s what makes Verifone a standout option for global SaaS operations:

Global Payment and Multi-Currency Support

Verifone simplifies international transactions with its ability to handle multiple currencies. This means businesses can accept payments from customers worldwide without hassle. The platform manages the complexities of cross-border transactions, including currency conversion and settlement in the merchant's preferred currency. It also supports both local and international payment methods, helping to reduce friction during checkout and improve conversion rates.

Automated Tax Compliance Made Easy

Handling taxes across multiple regions can be a logistical nightmare, but Verifone takes the burden off SaaS businesses. It automates the calculation, collection, and remittance of sales taxes, VAT, and other applicable taxes, ensuring compliance in all jurisdictions. The platform stays up-to-date with evolving tax regulations, so companies don’t have to dedicate resources to track changes themselves.

Subscription and Recurring Billing Solutions

Verifone streamlines subscription management by automating the entire billing process. From initial setup to renewals and handling failed payments, the platform supports flexible subscription models tailored to various business needs.

Developer Tools and Security Features

With a suite of APIs and SDKs, Verifone ensures seamless integration into existing systems. On top of that, it offers advanced fraud protection, including real-time monitoring and risk assessment, to safeguard businesses against chargebacks and security breaches.

Feature Comparison Table

A side-by-side comparison of providers makes it easier to understand how they measure up. Here's a breakdown of how five key players in the market perform across critical criteria for SaaS businesses:

| Provider | Supported Currencies | Tax Compliance Coverage | Recurring Billing | Developer Tools | Pricing Model | Main Advantages |

|---|---|---|---|---|---|---|

| Paddle | 20+ including USD, EUR, GBP | Global VAT, GST, US sales tax | Advanced subscription management | Comprehensive APIs, SDKs, documentation | Revenue share (custom rates) | Tailored for SaaS, strong global compliance |

| FastSpring | 20+ including USD, EUR, GBP | Global tax automation | Flexible billing cycles and logic | Developer-friendly APIs, integrations | Quote-based bundled fees | All-in-one platform, excellent onboarding support |

| Cleeng | 50+ major and minor currencies | Global VAT and sales tax | Subscription Retention Management suite | API with 50+ payment gateway integrations | Revenue share model | Advanced analytics, churn prevention |

| Dodo Payments | 10+ major global currencies | Select international markets | Basic recurring billing | Standard API support | Custom pricing | Ideal for freelancers, micro-SaaS |

| Verifone | 100+ currencies across 165+ countries | Comprehensive global compliance | Enterprise subscription automation | Enterprise APIs, SDKs, omnichannel tools | Custom enterprise pricing | Decades of experience, extensive global reach |

Currency and Payment Method Support

The range of supported currencies and payment methods varies widely. For example, Verifone leads the pack with support for over 100 currencies across 165+ countries. Cleeng, on the other hand, offers compatibility with 200+ payment methods. For US-based SaaS companies, all five providers handle USD transactions efficiently, but Verifone and Cleeng stand out for their extensive international reach. These capabilities are crucial for businesses aiming to cater to global audiences.

Tax Compliance

Tax compliance is another crucial factor. Each provider simplifies the process by automatically calculating, collecting, and remitting taxes across different jurisdictions. Paddle and FastSpring excel in handling US sales tax, while Verifone's long-standing expertise ensures reliable tax management on a global scale.

Pricing Transparency

Pricing transparency is a challenge across the board. Providers like FastSpring, Paddle, and Cleeng typically don’t disclose their rates publicly, requiring direct discussions to get specific pricing details. For SaaS businesses, this lack of clarity can complicate budgeting and scaling efforts, as it often involves negotiation and additional time to finalize agreements.

Developer Integration

Developer tools vary significantly depending on the provider. Paddle and FastSpring offer solid mid-market APIs, while Verifone provides enterprise-grade integrations, including omnichannel tools. Cleeng focuses more on its extensive payment gateway integrations rather than direct developer tools. Strong integration options ensure these platforms can adapt to the technical needs of SaaS companies as they grow.

For a deeper dive into these options, check out the guide titled Choose a Payment Provider for Your SaaS, which offers detailed filters and side-by-side comparisons.

Conclusion

Picking the right Merchant of Record (MoR) solution can play a crucial role in driving your SaaS business's global growth. The five providers we've covered - Paddle, FastSpring, Cleeng, Dodo Payments, and Verifone - each bring distinct advantages. The key is to align their offerings with your business's unique needs and stage of growth.

When evaluating options, focus on three main factors: scalability, compliance, and ease of integration. For example, Paddle’s all-inclusive pricing makes it a great choice for startups, while Verifone’s expansive global network is better suited for enterprise-level businesses aiming for significant international reach.

One of the biggest advantages of an MoR solution is its ability to handle compliance. These providers take on the heavy lifting of managing taxes, reducing administrative headaches and minimizing the risk of costly compliance errors. This becomes especially critical as your SaaS company ventures into international markets with ever-changing regulations.

Integration is another key consideration. Developer-friendly APIs and comprehensive documentation ensure a smooth onboarding process, helping you avoid disruptions while providing the flexibility to adapt as your business scales.

Once you've narrowed down your options based on core features, take advantage of additional resources to refine your decision. Tools like Choose a Payment Provider for Your SaaS can help you compare providers based on critical features like recurring billing, fraud prevention, and global tax compliance.

Ultimately, selecting the right MoR solution means choosing a partner that can grow with your business. From your early MVP days to scaling internationally, the right provider can simplify operations, enhance customer experiences, and support your expansion goals - all without the need for a platform switch. Matching the provider’s strengths to your current and future needs can lead to smoother operations and faster growth.

FAQs

What should SaaS businesses consider when selecting a Merchant of Record solution?

When picking a Merchant of Record (MoR) solution for your SaaS business, you need to prioritize global payment processing and regulatory compliance. The MoR takes care of credit and debit card transactions, ensuring payments are handled securely and efficiently for your customers.

Here are some critical aspects to consider:

- Multi-currency support: This allows you to serve customers worldwide without payment hurdles.

- Tax management: Look for a solution that handles VAT, sales tax, and other compliance requirements seamlessly.

- Fraud prevention: Strong measures are essential to safeguard both your business and your customers.

The right MoR can simplify your operations, minimize risks, and position your SaaS business for smooth global expansion.

What is a Merchant of Record solution, and how does it simplify global tax compliance?

A Merchant of Record (MoR) solution takes on the legal responsibility for processing your transactions, including managing global tax compliance. Essentially, they handle tasks like calculating, collecting, and remitting taxes - such as VAT or sales tax - on your behalf, ensuring your business stays aligned with international regulations.

When evaluating an MoR solution, prioritize features like automated tax calculations, adherence to local laws, and comprehensive reporting tools. These functions help streamline operations, minimize errors, and ease the challenges of managing transactions across multiple countries.

What are the advantages of using a Merchant of Record (MoR) solution for managing SaaS subscriptions and recurring payments?

Using a Merchant of Record (MoR) solution can be a game-changer for SaaS businesses, particularly those with a global reach. An MoR handles the tricky world of tax compliance, including VAT and sales tax, ensuring your business follows local regulations without needing to hire in-house specialists.

On top of that, MoR providers take care of recurring billing, payment processing, and fraud prevention. This not only simplifies your operations but also cuts down on administrative headaches. With these responsibilities off your plate, your SaaS company can focus on scaling and achieving growth, while the experts handle the legal and financial complexities.